The Canadian real estate market, long a subject of interest for investors and homeowners alike, finds itself at a significant juncture as the country’s mortgage landscape undergoes notable shifts. In the backdrop of these changes lies the central role of the Bank of Canada (BoC) and its recent announcements—or rather, the lack thereof—that have stirred expectations and projections.

The Dynamics of Canadian Mortgage Rates

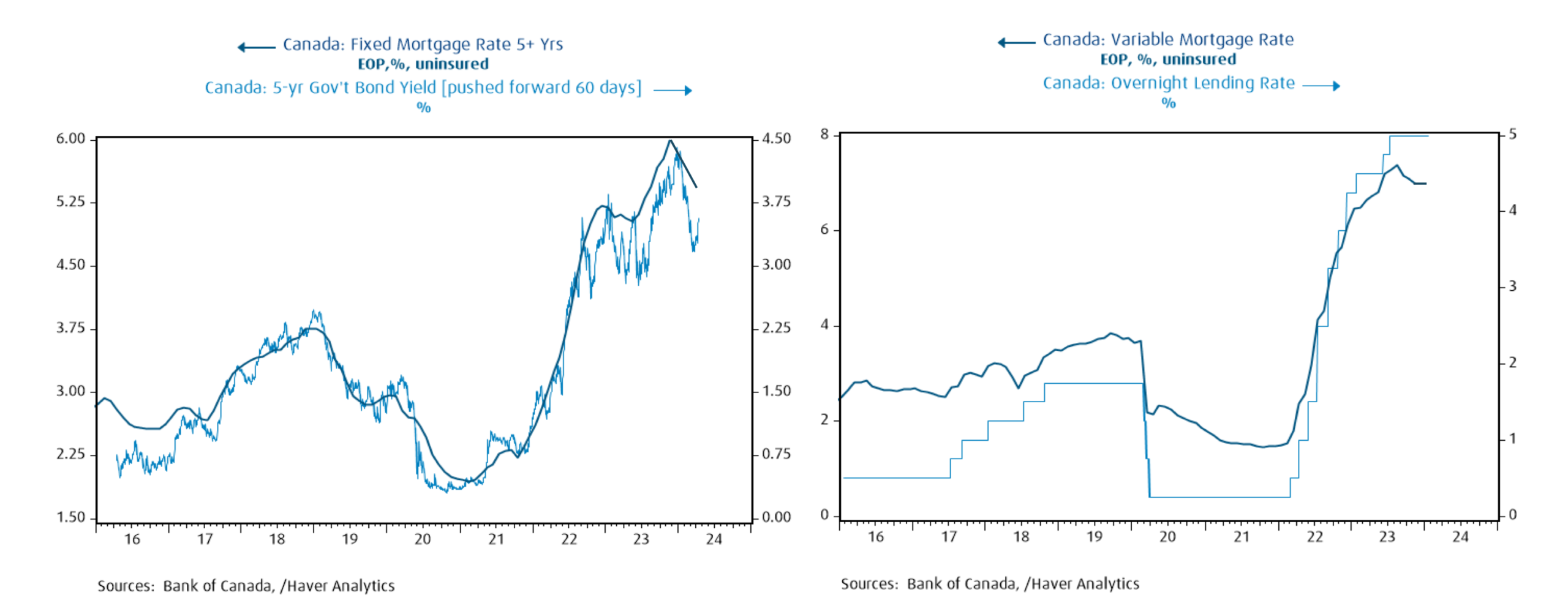

Understanding the Canadian mortgage market requires a grasp of its two primary interest cost categories: variable and fixed rate interests. Variable rate mortgages are directly influenced by the BoC’s key interest rate, known as the overnight rate. Conversely, fixed rate mortgages, which secure interest costs for their term, are swayed by the Government of Canada (GoC) bond yields.

Navigating the Currents of the Canadian Real Estate and Mortgage Markets

Despite the BoC’s recent inaction on the overnight rate, this non-move has significantly altered the landscape of expectations, affecting both variable and fixed rate mortgages.

The Overnight Rate Stands Still, But Expectations Shift

The latest announcement from the BoC maintained the status quo on the overnight rate, aligning with widespread predictions. However, the central bank’s nuanced shift in tone, hinting at a more patient approach to rate adjustments, caught the market somewhat off guard. Further, the BoC’s projection of inflation not returning to target until 2025 extends beyond most current forecasts.

Senior Economist at BMO, Robert Kavcic, notes, “While the BoC’s language changes indicate a halt to rate hikes, actual rate cuts seem to be a distant event.”

Fixed Rate Mortgages and Canadian Bond Yields

In the realm of fixed rate mortgages, there’s been a notable decrease in rates paralleling a drop in bond yields since their peak in October. This decline has translated into significant savings for borrowers. Yet, rising bond yields, spurred by altered expectations of inflation normalization, threaten to reverse this trend.

Kavcic warns that the recent uptick in yields could impede the downward momentum in mortgage rates, at least in the short term.

A Waiting Game for Canadian Mortgage Relief

For Canadians eyeing mortgage relief, the message is clear: patience is key. BMO’s outlook suggests little to no relief before the bustling Spring market. The narrative of cheaper mortgages might energize the Spring market, but significant reductions in fixed rates might take longer to materialize.

Kavcic remains cautiously optimistic about variable rate cuts, but he believes it’s premature to delve into specifics. “Variable rate cuts are a story for the latter half of the year,” he says, indicating that while rate relief is on the horizon, reaching it will require some endurance.

In summary, the Canadian real estate and mortgage markets are navigating through a complex phase, influenced heavily by the BoC’s strategic decisions and broader economic indicators. While the prospect of mortgage relief remains a beacon of hope, the journey there appears to require a blend of patience and strategic foresight. As the market adapts to these evolving circumstances, staying informed and agile will be crucial for investors, homeowners, and prospective buyers alike.

Source: BMO Capital Markets.